Key Takeaways:

- President Trump announced higher China tariffs after Beijing added port fees and new levies.

- The Dow plunged nearly 900 points, marking its lowest close since April.

- Experts and social media users warn this move is “really, really consequential.”

- Critics urge Congress to use its power to control tariffs and protect the economy

China Tariffs Shake Markets

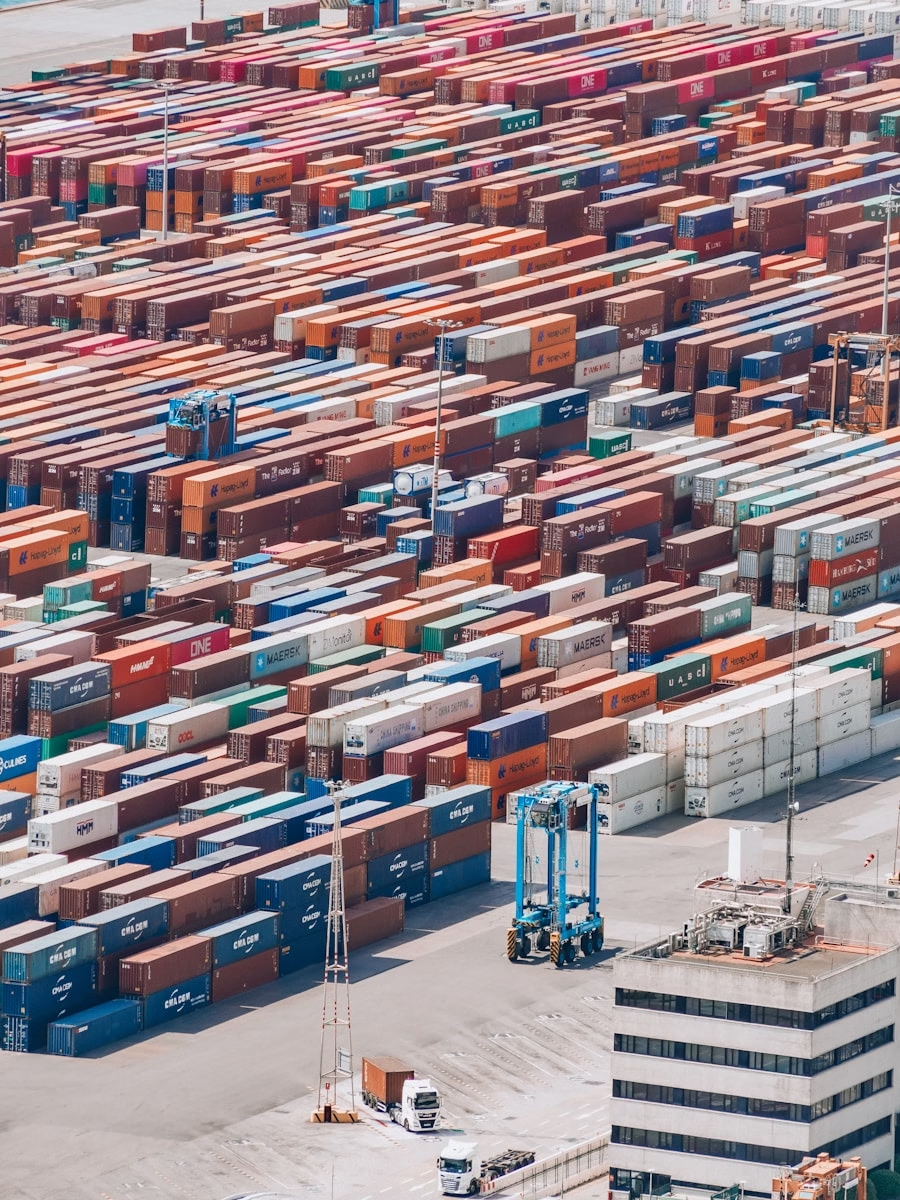

President Trump unleashed a series of posts on Truth Social. He said he would retaliate after China imposed extra port fees on U.S. ships. He also threatened to double existing tariffs. This back-and-forth is the latest chapter in their long trade war. As a result, the stock market fell sharply. In fact, the Dow closed almost 900 points lower than the previous day.

Why Trump Announced New China Tariffs

Trump argued that China’s new port fees were unfair to American exporters. He claimed these fees hurt U.S. farmers and manufacturers. Moreover, he said his tariffs would counter any Chinese advantage. He wrote that his plan would protect American jobs and industry.

However, critics warned that higher China tariffs could backfire. They pointed out that consumers might pay more for goods. They also noted that companies could move plants overseas. As a consequence, jobs might leave the United States.

China Tariffs: What Comes Next?

With both sides raising fees, uncertainty looms. Investors worry that trade tensions could last many months. As a result, businesses may delay new investments. In turn, this could slow economic growth.

Meanwhile, international partners watch closely. They fear a wider trade conflict could hurt global markets. Some countries already face slower growth. Higher China tariffs might add to their woes.

Investor Reactions to China Tariffs

Social media lit up with reactions when the market sank. Writer Joey Politano joked that traders panicked over a single tariff threat. CNN’s Phil Mattingly called the situation “really, really consequential.” Erik Durneika argued that the move seemed calculated. He said Trump has talked about tariffs for decades. University of Michigan professor Justin Wolfers reminded everyone that only Congress can set tariffs.

Such strong responses show how fragile market confidence has become. Even small shifts in policy can trigger big swings in stock prices. Investors now watch every tweet and statement with caution.

Economic Impact of New China Tariffs

Tariffs act like a tax on imports. When they rise, the cost of goods often goes up. For example, electronics, furniture, and clothes could become pricier. Consumers might cut back on spending. That, in turn, hits retailers and manufacturers.

Moreover, U.S. companies that rely on Chinese parts face higher costs. They may have to find new suppliers or pay more to keep current ones. Either way, profits could shrink. Consequently, share prices of these firms might fall.

Global trade also suffers. Other nations may step in to fill the gap left by U.S. and Chinese products. Over time, this can weaken ties between major economies. As a result, global growth may slow further.

What History Teaches Us About Tariffs

History shows that tariffs rarely produce only winners. In the 1930s, a major tariff law deepened the Great Depression. More recently, tariffs between the U.S. and its trading partners often hurt farmers and exporters. They end up paying a hidden tax.

At the same time, some industries benefit. Domestic steel and aluminum producers, for instance, can charge more without foreign competition. Yet, steel users like carmakers pay higher prices. This can reduce their sales or force them to cut jobs.

Therefore, balancing these effects is hard. Policymakers must weigh the gains for some sectors against the losses for others. They also need to consider the broader impact on consumers and global relations.

Political Debate Over China Tariffs

Critics say Congress should step in. The Constitution gives lawmakers the power to set and approve tariffs. Yet, recent presidents have bypassed Congress through emergency powers. Some argue this shift undermines democratic checks and balances.

Furthermore, political leaders differ on strategy. Some favor negotiation over tariffs. They believe dialogue can yield better long-term results. Others think only strong pressure will force China to change its trade practices.

For now, neither side shows signs of backing down. This push and pull could continue until both sides reach a new deal—or until one side faces too much pain.

Looking Ahead

As trade tensions rise, investors and businesses face uncertainty. They will watch upcoming meetings and statements for clues. Key dates include any planned high-level talks between U.S. and Chinese officials. Meanwhile, traders will track port fees and tariff announcements.

In the short term, stock markets may remain volatile. Companies might issue profit warnings if costs rise further. Consumers could postpone big purchases, fearing higher prices. The overall economy may slow as a result.

Yet, there is still room for compromise. If both sides agree to roll back some fees, markets could recover. A partial deal might lift business confidence and boost spending.

Navigating this landscape will require careful planning. Companies should explore alternative suppliers and hedge against price spikes. Investors may seek safe havens such as bonds or gold. Consumers can compare prices and look for discounts.

Ultimately, the impact of China tariffs will depend on how long tensions last. If the standoff ends soon, the damage may be limited. However, a prolonged trade war could leave lasting scars on the global economy.

Frequently Asked Questions

How do China tariffs affect everyday consumers?

Tariffs on Chinese goods raise import costs. Retailers often pass these higher costs to shoppers. This means everyday items can become more expensive.

Can the U.S. Congress stop new tariffs?

Yes. The Constitution gives Congress the power to set and approve tariff rates. In theory, lawmakers could repeal or limit tariffs through new laws.

Why did the Dow drop almost 900 points?

Investors feared that higher China tariffs would hurt company profits. This worry led many to sell stocks, causing the market to fall sharply.

Is there a timeline for lifting China tariffs?

No official timeline exists. Future tariff changes depend on negotiations and political decisions by both governments.