Key takeaways:

- President Trump’s threat to impose 100% tariffs on China sent stocks tumbling.

- Major indexes fell sharply after his announcement.

- Trump’s follow-up message failed to calm investors.

- Financial experts criticized his strategy on social media.

- Markets now await clear policy signals, not just strong words.

The shocking threat and market plunge

Last Friday, President Trump announced he would slap China with 100% tariffs. He made the claim on social media. However, stocks sank right after the warning. The tech-heavy Nasdaq Composite fell 3.6%. The S&P 500 lost 2.6%. The Dow Jones slid 1.9%. This sudden drop showed how sensitive markets are to trade talk. In fact, the mere hint of new Trump China tariffs stirred real fear.

Impact of Trump China tariffs on markets

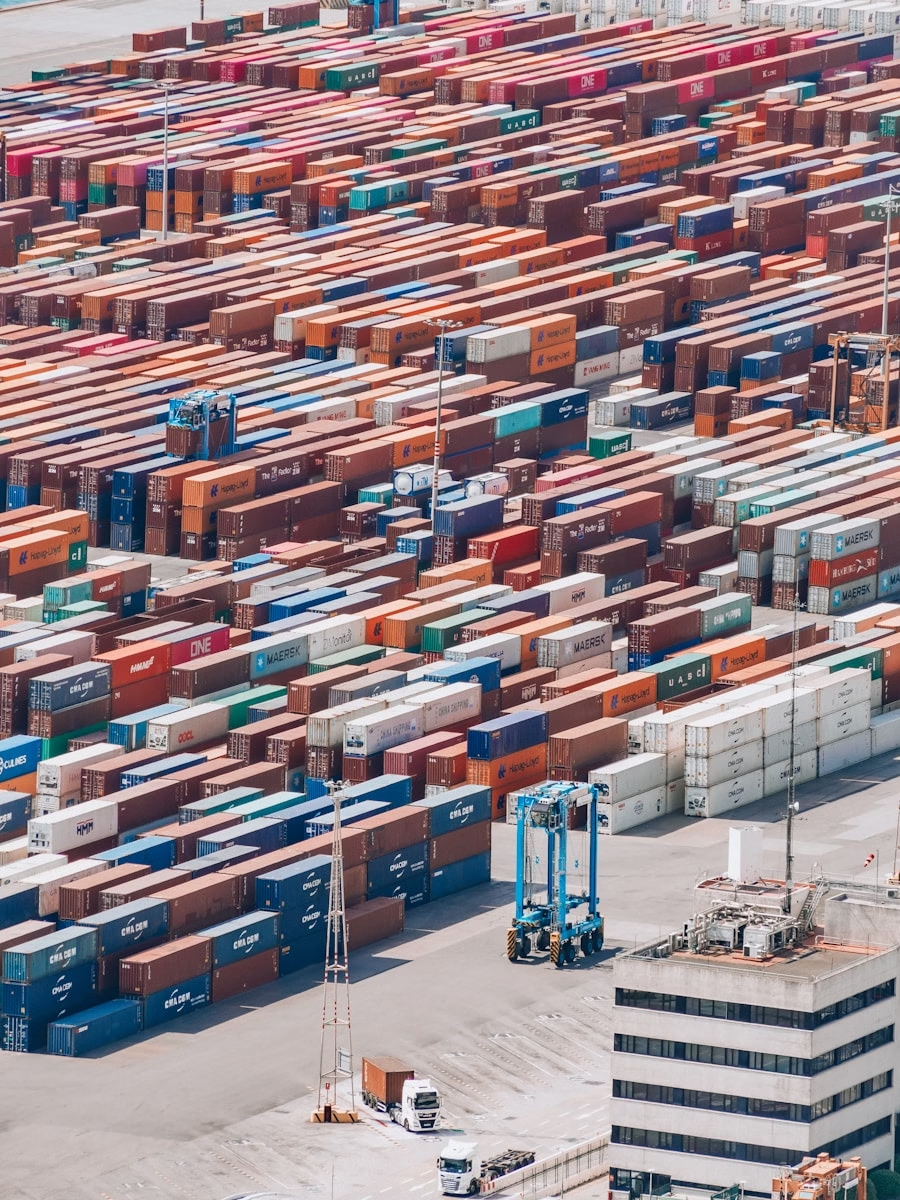

When traders heard about the planned Trump China tariffs, many rushed to sell. They feared higher costs for goods and slower company profits. As a result, stock prices dropped across the board. Moreover, businesses worried about supply chain disruptions. They feared raw materials and electronics would get more expensive. Consequently, investor confidence took a hit. Thus, even a tweet can reshape market moods.

How Trump tried to soothe fears

Over the weekend, Trump pushed back against the panic. He posted on his platform that China’s leader had just “a bad moment.” He said both nations wanted to avoid a depression. He also claimed the U.S. aimed to help China, not hurt it. Yet, instead of calming nerves, this message intensified doubts. Investors saw mixed signals. They could not tell if the threat was real or just negotiation drama.

Reactions from experts and observers

Financial experts raced to comment online. Some mocked the abrupt shift in tone. Others warned that this back-and-forth harms America’s credibility. Here are a few of their reactions:

• Peter Schiff, a well-known economist, noted that admitting the threat was just a bluff weakens your hand.

• Spencer Hakimian compared the erratic trade drama to a high-school romance with its ups and downs.

• A veteran observer pointed out that without true China experts, such confusing messages will keep coming. He stressed that China acts patiently and will not ignore empty threats.

• University economists highlighted that no one wants to make a long-term deal when the rules can change overnight.

Why the mixed messages matter

Trade policy relies on clear signals. When a leader bluffs and then backs off, partners lose trust. Consequently, business leaders hesitate to invest. They do not know what rules will apply next month. Therefore, markets react not only to actual tariffs but also to the uncertainty around them. In short, shaky policy talk can be as disruptive as real trade barriers.

What’s next for trade and investors

For now, investors will watch two things closely. First, any concrete steps from the White House or Treasury. A real tariff order would require formal notice and a grace period. Second, any fresh comments from China’s leadership. Beijing might respond in kind or seek talks. Until then, market swings will persist. Traders will jump at any hint of progress or conflict.

Lessons for future negotiations

This episode offers several takeaways:

• Avoid public threats without a plan. Empty warnings can erode credibility.

• Keep communication consistent. Mixed messages create confusion at home and abroad.

• Rely on experts. Involving seasoned trade negotiators and analysts can prevent missteps.

• Manage market expectations. Clear, step-by-step updates help investors adjust.

In addition, this saga shows that social media posts can move global markets. A single message from the president can spark rallies or sell-offs within minutes. Therefore, leaders must weigh their words carefully. They can trigger real economic effects even before any policy hits paper.

Why traders should pay attention

First, markets hate uncertainty. They crave clear rules and predictable policy. Thus, whenever trade relations seem unstable, traders brace for losses. Second, this event shows how tech stocks remain vulnerable. Many key players import parts from China. They depend on smooth cross-border shipments. When tariffs rise, their costs go up. Finally, small businesses and consumers could feel the pinch. Higher import costs often translate into higher prices for everyday goods.

The road ahead for Trump China tariffs

Will the president follow through on his 100% tariff threat? It remains unclear. On one hand, a firm stance might win public support among certain voters. On the other hand, it risks harming U.S. companies and shoppers. Moreover, China could retaliate with its own duties. Such a trade war could drag on for years. Therefore, most analysts expect the threat to turn into negotiation leverage rather than an actual doubling of taxes on imports.

Summary and outlook

In the end, the Trump China tariffs drama taught investors a vital lesson: watch both words and actions. Bold threats can shake markets. But only concrete policy changes bring lasting effects. For now, traders will look for official notices from the government. They will also parse every statement from Chinese authorities. Until then, volatility will likely remain high.

FAQs

How did markets react to the 100% tariff threat?

Major indexes plunged immediately after the announcement. The Nasdaq fell the most, shedding over 3%.

Did Trump calm investors with his follow-up message?

No. His reassurance on social media created more doubt. Experts said it showed a weak negotiating stance.

Why do mixed messages matter in trade policy?

Uncertainty makes businesses and investors reluctant to plan. Clear, consistent communication helps markets stay stable.

What could happen next in U.S.-China trade relations?

The White House might formalize tariffs or seek new talks. China could mirror U.S. moves or offer concessions. Either way, markets will stay alert.