Key Takeaways:

- Parents may find a thinner toy selection this Black Friday week.

- U.S. toy tariffs rose to 22 percent this year.

- Toy imports fell by over 25 percent since May.

- Small shops face higher costs and empty shelves.

How Toy Tariffs Are Emptying Shelves

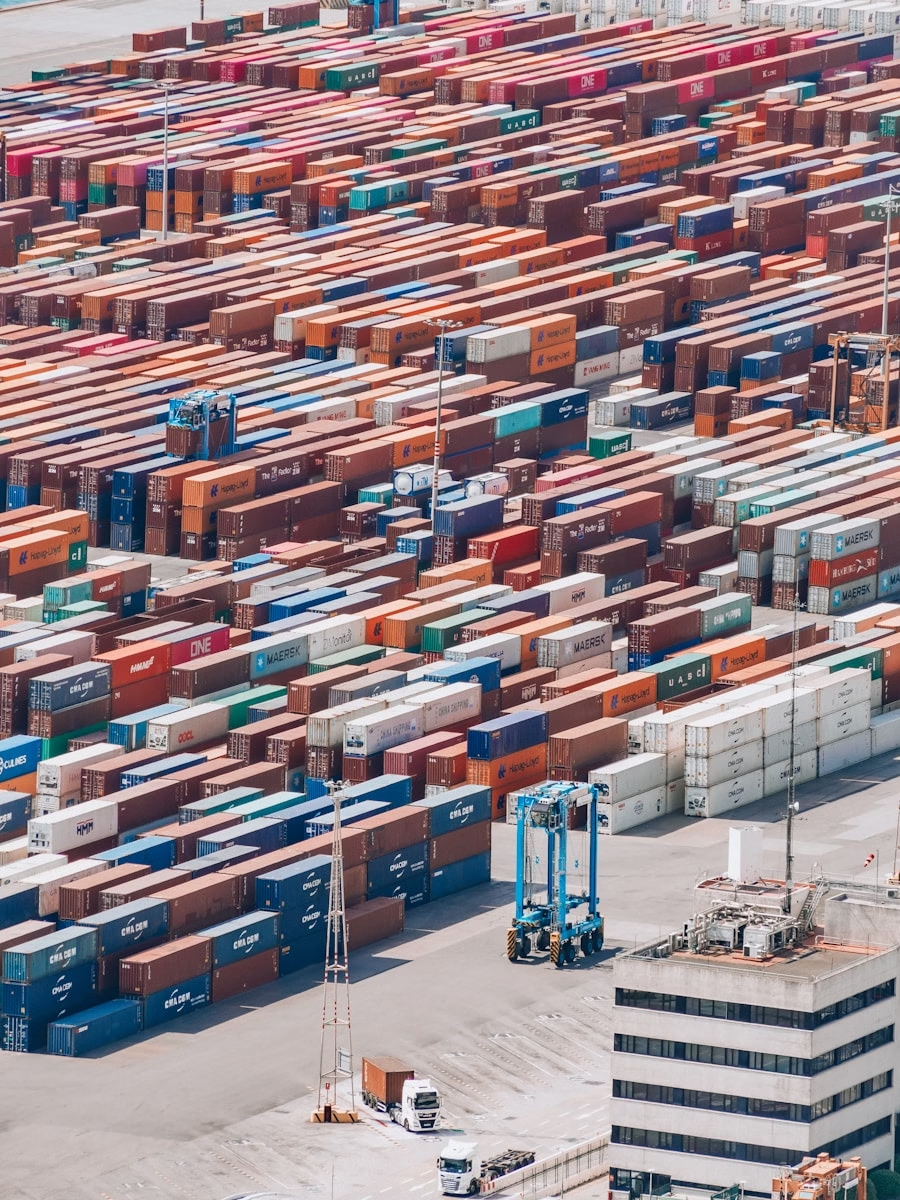

This holiday season may feel odd for many families. Parents who shop late could face near-empty aisles. Early reports warn that toy shipments slowed sharply. Supply chain experts point to a big change. They say new toy tariffs raised costs. As a result, containerized toy imports dropped double digits each month since May. In August, they fell by twenty-six percent from last year. Experts track shifts in dolls, action figures and bikes. Moreover, higher fees add weeks to delivery times. Some ports face backlogs, delaying shipments even more. Meanwhile, big retail chains use their buying power to stay stocked. They can pay higher duties and keep prices low. Small stores have no such cushion. Therefore, stores of all sizes see gaps on their shelves. Parents may find popular toys sold out. In turn, this alters gift plans and budgets.

Why Toy Tariffs Hurt Small Shops

Small business owners say rising duties hit them hardest. Shops must pay toy tariffs before unloading goods. That ties up cash flow at critical times. Then they mark up prices to break even. Big chains use bulk discounts to undercut smaller rivals. For example, a main street toy shop paid twenty percent more per shipment. Without deep discounts, it struggled to attract customers. Shop owners worry they will lose holiday sales. Some fear they might close next year. In addition, small shops lack strong bargaining power with suppliers. They cannot demand lower base prices. Thus, they order fewer toys, limiting their choices. Moreover, store owners report that late shipments frustrate loyal shoppers. Some kids now miss their favorite items. As a result, local communities lose shopping spots. Keeping the holiday spirit alive becomes harder.

Data Shows a Sharp Drop

Trade statistics reveal a steep decline in toy imports. After a strong start in early 2025, tonnage plunged by May. Each month showed at least a ten percent drop. Two months saw declines exceeding thirty percent. These figures include everything from stuffed animals to electric scooters. Jason Miller, a professor at Michigan State, led the analysis. He notes that before tariffs, imports grew steadily. Yet when the duty rate jumped from zero to twenty-two percent, shipments slowed. The new fees made Chinese-made toys much pricier. Although more data will come later, current trends worry retailers. Few expect a sudden rebound before the holiday season. Consequently, many buyers place smaller orders to avoid excess inventory.

Coalition Highlights Rising Costs

A coalition of U.S. business owners called We Pay the Tariffs shares stories. They report paying 1.2 billion dollars in duties on all imports for eight months. Toys formed a large slice of that total. Businesses say these fees force them to raise prices on customers. Many fear shoppers will choose cheaper online alternatives instead. The group collects real fee data and firsthand accounts. Owners describe paying fees on every container at the port. Then they struggle to recoup costs when toys stay on shelves unsold. Furthermore, they worry about competing against massive online giants. Those giants swallow fees and lure buyers with big sales. In the end, small shops say toy tariffs threaten their future viability.

The Price Effects of Toy Tariffs

Toy tariffs drive prices up for shoppers. Stores mark up costs to cover duties. As such, toys cost more now than last year. Some popular dolls rose by fifteen dollars or more. Budget brands saw five to ten dollar increases. These hikes force families to rethink gift lists. Parents must stretch budgets further or skip extras. Meanwhile, big retailers use deep promotions to offset higher costs. They offer bundles or free shipping to keep customers. Yet local shops cannot match such deals. They try to offer unique items or personal service instead. However, many still struggle to price competitively. Therefore, the burden of toy tariffs shows up in checkout totals.

Global Shifts in Toy Sourcing

U.S. importers look beyond China for supplies. Countries such as Vietnam and Mexico gain market share. They offer lower fees or faster shipping times. Yet they lack China’s massive production capacity. Some factories there work around the clock to meet demand. Altogether, China still accounts for over sixty-seven percent of U.S. toy imports this year. Importers say Chinese goods start cheaper, even before duties. However, switching factories is not a quick fix. Suppliers need time to build new lines and train workers. Also, quality control can vary. Therefore, many buyers stick with known Chinese partners. Still, more firms plan gradual shifts to diversify sources. That strategy may pay off if tariff talks stall.

How Parents Can Adapt

Shoppers will need new strategies this season. First, start browsing early in November to spot deals. Second, compare prices across online and local stores. Some small shops offer holiday loyalty perks. Third, consider alternate gift options, such as puzzles or books. These items may face lower import fees. Fourth, look for toys made in Vietnam or Mexico, if brands you like source there. They often cost a bit more, but they stay in stock. Fifth, mix in gift cards or DIY craft kits as backups. That ensures every child still feels special. Finally, track shipment dates online and reserve gifts ahead. Doing so reduces the pain of empty shelves.

Looking Ahead: Possible Solutions

Lawmakers consider carving out toy exemptions from tariffs. That move could ease fees during peak seasons. Others propose faster refunds for overpaid duties. They say quicker cash returns help small shops restock. Meanwhile, trade negotiators could include toy tariff cuts in broader agreements. Reducing barriers might boost imports back to normal levels. Retail associations also call for longer planning windows. They want clarity on fee schedules months ahead. That information lets them set budgets and place bigger orders. If talks succeed, shoppers may see fuller aisles next year. However, if fees stay, shortage risks will persist.

Conclusion

This holiday season reveals how trade policy affects daily life. New toy tariffs led to fewer shipments and higher prices. Small shops face empty shelves and tighter budgets. Parents must plan early and get creative with gifts. Although China still dominates toy production, some buyers spread orders to other countries. In time, policy changes could restore normal supply. Until then, smart shopping and early planning remain key to finding holiday treasures.

FAQs

Why did toy tariffs jump this year?

The U.S. raised duties on toys to twenty-two percent. It aims to protect domestic industries.

Which toys face the biggest shortages?

Items made in China saw the sharpest import drops. That includes dolls, bikes and electric scooters.

Can small stores avoid high fees?

They can choose local suppliers or import from low-fee countries. Yet few options match China’s scale.

What can families do to beat shortages?

Shop early, compare prices online, and try gifts like puzzles or books. Reserve hot items before they sell out.